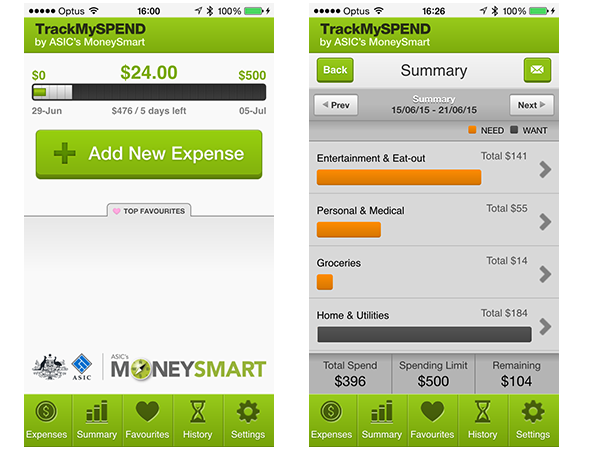

Users can access up to 20 envelopes in the free version & unlimited envelopes in the paid version.įind out more: PocketGuard – Simplified Budgets.Improve your financial knowledge through the app by accessing well-curated podcasts, budgeting bootcamp webinars, and blogs.The only drawback is that bank details don’t automatically sync they need to be entered manually. That’s what Goodbudget facilitates – a digital envelope system of saving money where you can divide and assign monthly funds into various spending categories such as groceries, rent, utilities etc.

#App to manage monthly expenses software

Users can easily access personalised insights and monitor subscriptions.

Mint’s array of features allows you to quickly categorise transactions from linked accounts, and create custom budgets.The app allows users to manage and track expenses, make credit payments, savings and checking accounts, loans, bills, and investments. With one of the highest ratings, reviews, and downloads, Mint is a free to use budgeting app which allows users to sync all their different accounts on the platform. Note: SG Alliance does not endorse, nor have affliations with the below-mentioned apps. Based on my experience of using the top budgeting apps on the Google Play Store and the iOS App Store, here are my recommended budgeting apps for 2022. When it comes to filtering and choosing the best budgeting app(s), you should know which one is the most unique or offers exclusive tools. Basic budgeting apps help you connect your accounts, categorise and track expenses, create saving goals, alert you for payments, and even highlight where you can cut back. If you’re looking for ways to control your personal expenditure and savings, a budgeting app may come in handy.

0 kommentar(er)

0 kommentar(er)